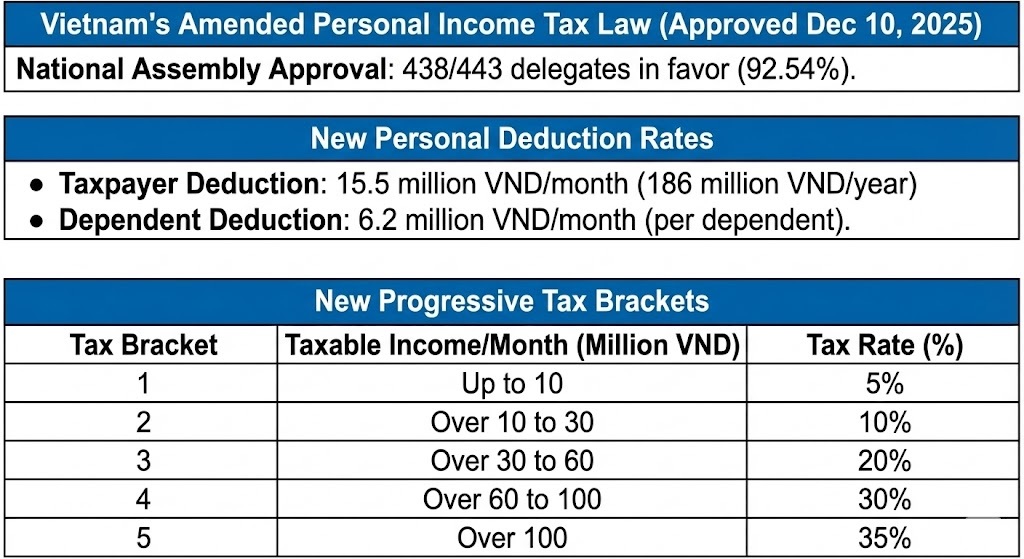

On the morning of 10 December, the National Assembly officially approved the amended Personal Income Tax Law, with 438 out of 443 delegates voting in favor (92.54%).

Under the new law (effective from 01 July 2026), the family circumstance-based deductions applicable to resident individual taxpayers receiving employment income are as follows:

• Deduction for the taxpayer: 15.5 million VND per month (equivalent to 186 million VND per year)

• Deduction for each dependent: 6.2 million VND per month

The revised progressive tax schedule now consists of 5 tax brackets, with income thresholds increasing by 10, 20, 30, and 40 million VND. Tax rates remain at 5%, 10%, 20%, 30%, and 35%, with the top rate of 35% applied to taxable income exceeding 100 million VND per month.

- Notes:

The progressive personal income tax schedule for 2026 (5-tier tax table) will be applicable from July 1, 2026.

Regarding the new personal deduction levels: The government has incorporated the personal deduction levels stipulated in Resolution 110 of the National Assembly Standing Committee into the regulations of the law. Therefore, the understanding is that the new personal deduction levels will apply from January 1, 2026.

A visual summary of the new progressive tax brackets is provided in the chart enclosed.